Disclaimer: The articles published here on the City of Eau Claire Economic Development Division website are meant to be a helpful starting point as you explore doing business in our community. They’re not the final word on requirements or what’s best for your unique situation. We always recommend checking in with legal, financial, or other professionals for advice tailored to your business.

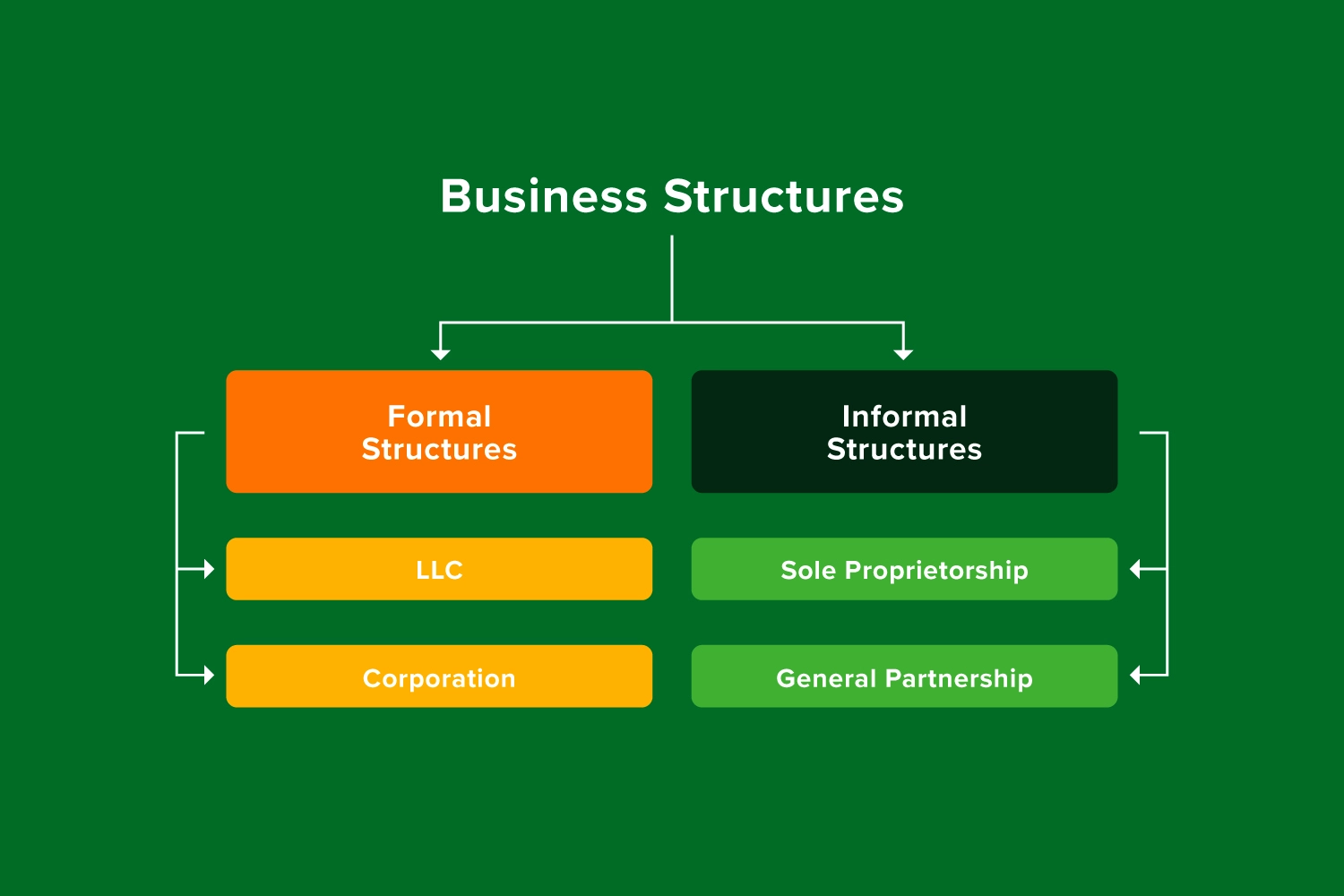

When you’re starting a business in Eau Claire, there’s a lot to think about—funding, location, marketing—but one decision you can’t overlook is how you’ll legally structure your business. It’s tempting to pick whatever sounds easiest, but your business structure plays a big role in how you’re taxed, how much personal liability you have, and how your business operates day to day.

So, what are your options, and which one makes the most sense for your Eau Claire startup or small business? Let’s break it down.

Sole Proprietorship: Simple & Straightforward

This is the most basic and most common setup for solo entrepreneurs. If you’re running a business on your own—maybe you’re a freelance designer, at-home baker, photographer, or lawn care pro—you’re probably a sole proprietor by default. There’s typically no formal registration required beyond any necessary industry-based licenses or permits, so it’s often the go-to for side hustles or early-stage businesses.

In Eau Claire, many entrepreneurs start here when testing out an idea. It’s quick to launch, low-cost, and easy to pivot as your business grows.

Benefits:

- Easy & Inexpensive to Start: No need to file formation paperwork with the state unless you need a special professional license. Usually, all you need is a business name registration and local permits.

- You’re in Full Control: As the sole owner, you make every decision; no need to check in with partners or a board.

- Simple Taxes: Your business income is reported directly on your personal tax return using a Schedule C form. No separate tax return required.

Keep in mind, there’s no legal line between you and your business. That means if the business takes on debt or gets sued, your personal assets could be on the line. It can also be harder to raise funds or hire employees under this structure, which is why some Eau Claire business owners start as sole proprietors and switch to an LLC later for more protection.

And don’t forget, if you’re using a business name that doesn’t include your own legal name, you’ll still need to register a “Trade Name” (also known as a DBA) even as a sole proprietorship. It’s a simple but important step to keep things legal, especially if you’re setting up a website or opening a bank account.

Partnership: Built for Two (or More)

If you’re teaming up with someone—as in, you’re opening a café, launching a creative agency, or starting a landscaping company together—a partnership might be the right move. This structure is made for two or more owners who want to share responsibilities, decisions, and profits.

There are two main types to consider:

- General Partnership (GP): All partners share equal responsibility for managing the business and its obligations.

- Limited Partnership (LP): One or more partners handle operations, while others invest money but remain hands-off.

In Eau Claire, partnerships are common among co-founders, family businesses, and service providers who want to combine skills and resources.

Benefits:

- Simple to Form: Like sole proprietorships, partnerships don’t require state-level registration (unless forming an LP or LLP). Just register your business name and get any necessary licenses or permits.

- Shared Costs & Responsibilities: You’re not going it alone; partners bring capital, expertise, and connections to the table.

- Pass-Through Taxation: The business doesn’t pay income taxes directly. Instead, profits and losses pass through to each partner’s personal tax return based on their ownership share.

Keep in mind, just because it’s easy to form doesn’t mean you can skip the paperwork. A written partnership agreement is essential. It should outline:

- Each partner’s role

- How profits and losses are divided

- How decisions are made

- What happens if someone wants to leave or if the business dissolves

Without an agreement, Wisconsin’s default partnership laws take over, which may not work in your favor. If your business name doesn’t include all partners’ last names, be sure to file a DBA for this structure too. And don’t skip the step of sitting down with an attorney or accountant to draft an agreement that fits your goals. A partnership can be a great way to build something together, but only if everyone’s on the same page from day one.

Limited Liability Company (LLC): A Favorite for Small Businesses

LLCs are one of the most popular choices for entrepreneurs in Eau Claire, and for good reason. They combine the simplicity of a sole proprietorship or partnership with the liability protection of a corporation. Whether you’re opening a storefront, launching an online business, or running a consulting firm, an LLC offers a flexible and smart structure.

Benefits:

- Personal Liability Protection: Your home, car, and savings are generally protected if your business runs into legal or financial trouble.

- Flexible Tax Options: By default, a single-member LLC is taxed like a sole proprietorship, and a multi-member LLC like a partnership. But you can also elect to be taxed as an S-Corp or C-Corp if it benefits your situation.

- Less Red Tape than a Corporation: You won’t need to hold annual meetings or keep detailed board minutes, which makes day-to-day management easier, especially for solo owners or small teams.

Keep in mind, setting up an LLC in Wisconsin does take a few steps:

- File Articles of Organization with the Wisconsin Department of Financial Institutions (DFI)

- Pay a one-time filing fee

- Designate a registered agent

- Create an Operating Agreement

You’ll also need to file an annual report to keep your LLC in good standing. If you need a hand, the Wisconsin SBDC at UW-Eau Claire offers free advising and can help walk you through each step. Their support can make filing a lot less intimidating.

Corporation (C-Corp): Built to Scale

C-Corps are the most structured and most complex business type. They’re designed for companies that plan to raise capital, issue stock, or eventually go public. While most small businesses in Eau Claire don’t start out as C-Corps, this structure can make sense for startups in tech, manufacturing, or other high-growth sectors that need outside investors.

Benefits:

- Strong Liability Protection: Like an LLC, a C-Corp keeps your personal assets separate from business liabilities.

- Unlimited Investors: You can issue multiple classes of stock and take on an unlimited number of shareholders, making this structure ideal for attracting venture capital.

- Stock Options for Employees: Equity can be a great way to recruit and retain top talent if you’re planning to scale.

Keep in mind, C-Corps come with more formality and paperwork:

- Draft corporate bylaws and file Articles of Incorporation

- Hold annual shareholder and board meetings

- Maintain corporate records and meeting minutes

- File a separate corporate tax return

And yes, double taxation applies. The corporation pays taxes on its profits, and shareholders pay taxes again on dividends.

If you’re not sure whether your business needs this level of structure, talk to a tax advisor or the SBDC at UW-Eau Claire. They can help you weigh the pros and cons based on your long-term goals. Bottom Line: C-Corps aren’t necessary for most small businesses, but they’re a great fit if you’re building something big and aiming for investment.

S Corporation (S-Corp): A Tax-Savvy Option—for the Right Business

Here’s where things get a bit more technical. An S-Corp isn’t a business structure on its own. It’s a tax status that eligible LLCs or corporations can elect. The main perk is that it could save you money on self-employment taxes. If your business in Eau Claire is generating consistent profits and you’re already operating as an LLC or corporation, switching to S-Corp taxation might make sense.

Benefits:

- Avoids Double Taxation: S-Corps are pass-through entities, so income flows directly to your personal tax return—no corporate tax filing.

- Lower Payroll Taxes: You’ll pay yourself a “reasonable salary” (subject to payroll taxes), but any additional profits you take as distributions aren’t hit with self-employment tax.

- Limited Liability Protection: Choosing S-Corp status doesn’t affect your legal protections; you still enjoy personal liability coverage.

Keep in mind, S-Corps have a few strict rules. To qualify, your business must:

- Be U.S.-based

- Have no more than 100 shareholders

- Offer only one class of stock

- File IRS Form 2553 on time

You’ll also need to run payroll and pay yourself a consistent, reasonable wage. It’s more administrative work, and if done incorrectly, it could trigger IRS scrutiny.

If you’re thinking about making the switch, talk to a CPA or business advisor. Many Eau Claire entrepreneurs wait until they’re earning at least $40,000–$50,000 in profit before electing S-Corp status to make the extra paperwork worth it. The SBDC at UW-Eau Claire can help you crunch the numbers and decide what’s best.

So… What’s the Best Structure for You?

There’s no universal answer. It really depends on your business goals, whether you’re going solo or partnering up, and how much legal protection you want from day one. Many Eau Claire entrepreneurs start as sole proprietors or LLCs and adapt their structure as the business grows. The good news is you’re not locked into one forever and can always switch structures down the road. You’re also not alone in deciding… The Wisconsin Small Business Development Center (SBDC) at UW-Eau Claire as well as many other regional partners offer free advising to help you make an informed decision that fits your vision and your bottom line.

Choosing a business structure is one of the most important steps for a startup, so take your time, ask questions, and get advice. It’ll pay off in the long run.

Article Cover Illustration by Freepik