Disclaimer: The articles published here on the City of Eau Claire Economic Development Division website are meant to be a helpful starting point as you explore doing business in our community. They’re not the final word on requirements or what’s best for your unique situation. We always recommend checking in with legal, financial, or other professionals for advice tailored to your business.

If you’re starting or growing a business in Eau Claire, one of the biggest challenges is figuring out how to finance your dreams. Luckily, the City of Eau Claire offers business loans designed to help local businesses thrive. But here’s the catch: These City loans typically have to be paired with other types of financing.

Let’s dive into why mixing funding sources could be the smart move your business needs.

Why Combine Funding Sources?

Starting or growing a business usually requires more than one pile of money. No single funding source typically covers every expense, especially when you’re juggling inventory, equipment, marketing, and staff. That’s where combining financing becomes important.

City of Eau Claire business loans are great at filling those crucial funding gaps, whether it’s buying new equipment, covering day-to-day expenses (also known as working capital), or financing a big expansion. But on their own, these loans might not cover 100% of what your business needs, and that’s very common.

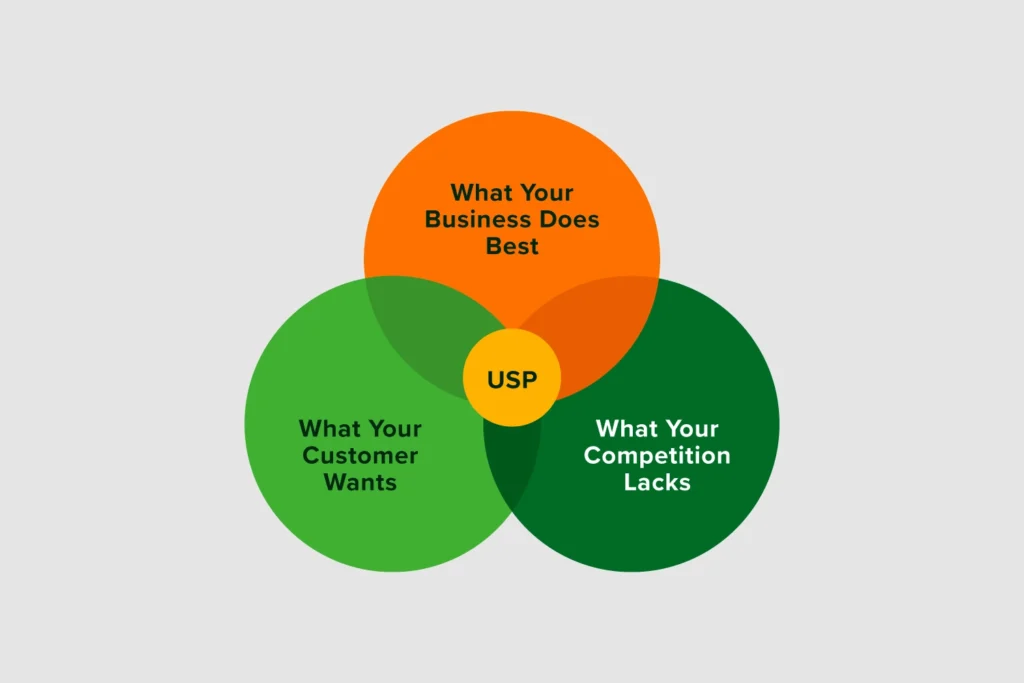

By blending a City loan with other financing like a traditional bank loan, a grant, or private investment, you can build a complete funding package that fits your business like a glove. Think of it like assembling a puzzle: Each funding source is a piece, and together, they create the full picture. Plus, spreading your funding across different sources lowers your financial risk. Instead of leaning heavily on one loan with high payments, you balance things out. This can help keep monthly repayments manageable and improve your cash flow.

There’s more. Using multiple funding sources can boost your credibility with lenders and investors. It shows you’re serious, resourceful, and have a well-thought-out plan, which can increase your chances of approval and even open doors to better loan terms or new funding opportunities.

Bottom Line: Mixing and matching your financing gives you flexibility, reduces risk, and unlocks more chances to turn your business vision into reality.

How City of Eau Claire Loans Fit In

City of Eau Claire business loans are tailored for local entrepreneurs, meaning loan terms, interest rates, collateral requirements, and repayment schedules are designed to support the unique needs of businesses right here in our community. These loans often come with competitive interest rates that can be more affordable than many traditional lending options. Plus, flexible repayment terms make managing cash flow easier as you grow.

One of the biggest perks is these loans prioritize projects that create jobs or add value to Eau Claire. So, if your plans involve hiring local talent, expanding your footprint, or launching something that benefits the community, City loans could be a perfect fit.

Because the City backs these loans, the approval process can sometimes be more flexible than working with a big bank. This is especially helpful if you’re a newer business without a long credit history or if your project is a bit unconventional. The City of Eau Claire Loan Administration Board (LAB) understands local market conditions and the challenges entrepreneurs face, so they’re often more willing to take a chance on promising ideas that might not fit typical bank criteria.

That said, City business loans usually don’t cover every dollar your project requires. They’re designed to fill the “gap”—the difference between what you can raise through other means (like savings, bank loans, or grants) and your total project costs. That means you’ll likely need to combine your City loan with other financing sources to cover your full budget.

In short, think of City loans as a valuable piece of your financing puzzle. They help you get closer to your goals by filling critical funding holes, but pairing them with other loans, investments, or grants gives you the full financial foundation to succeed.

Pairing with Traditional Bank Loans

If you’re financing your business, you’ve probably already considered a bank for a loan. Traditional bank and credit union loans are common and reliable, but these institutions often have strict criteria. They want to be sure your business is financially stable and can repay the loan.

That’s where City of Eau Claire loans make a great complement. Many business owners use City loans alongside bank loans to bridge the gap between what the bank will lend and the total project cost. For example, if your project costs $100,000 but the bank will only lend $70,000 based on your finances, a City loan can cover the remaining $30,000. This “gap-filling” role is one of the biggest advantages of combining the two.

Why does this matter? Banks like to see you’ve secured additional funding, whether it’s from the City, investors, your own savings, and so on. It shows you have a solid plan and aren’t relying solely on bank financing. This lowers the bank’s risk and boosts your approval chances. Also, having multiple funding sources can help you negotiate better loan terms. With less risk, banks might offer more flexible interest rates, repayment schedules, or collateral requirements.

In short, pairing a City of Eau Claire loan with a bank loan is a smart way to build lender confidence and strengthen your financial footing. Bringing lenders together creates a more balanced, secure foundation for your business to grow.

Finding Grants & Other Incentives

One of the best things about starting or growing a business in Eau Claire, and Wisconsin in general, is the variety of grants and incentives available to support entrepreneurs, especially if your business focuses on innovation, sustainability, or creating local jobs.

Unlike loans, grants are essentially “free money.” You don’t pay them back, which makes grants a golden opportunity to boost your business without adding debt. Whether it’s a state grant for energy-efficient upgrades, a local program supporting women-owned startups, or funds aimed at hiring new employees, grants can really improve your project’s bottom line. Pairing grant money with a City of Eau Claire loan can be a game-changer too. For example, a grant that covers part of your costs means you borrow less. That often means smaller loans, lower monthly payments, and less financial pressure as your business takes off.

Beyond grants, there may be tax incentives, rebates, and other programs available from local and state agencies depending on the project. These can lower operational costs or provide credits that improve cash flow. It’s worth exploring these options early to maximize your funding mix.

The key is to not overlook grants and incentives just because they seem competitive or complicated. Many programs exist specifically to help businesses in smaller cities like Eau Claire succeed. Plus, local partners exist to help you find grants that fit your business and guide you through applying.

By combining grants and incentives with City loans and other funding, you build an even stronger financial foundation—giving you more freedom to focus on growing your business, not just repayments.

Considering Crowdfunding & Private Investment

If you already have a loyal community or a story that really connects, crowdfunding might be a great way to bring in funds while building buzz for your business. Platforms like Kickstarter, Indiegogo, or GoFundMe let you share your idea with a wide audience who can chip in small amounts that add up fast. The best part is you’re not just raising money either; you’re building a community of supporters who will likely become your very first customers, brand ambassadors, and cheerleaders.

Crowdfunding works especially well if your business offers something unique or tied to a cause people care about. Plus, it’s a way to test market interest before going all-in. Keep in mind that a successful campaign does take storytelling and follow-up, but the payoff can be huge.

On the private investment side, angel investors, venture capitalists, or even friends and family can be great partners. They bring money, experience, advice, and connections that help your business grow. Plus, private investment can fill financing gaps that bank loans or city loans don’t cover.

When you pair crowdfunding or private investment with a City of Eau Claire loan, you create a balanced financial portfolio. Instead of relying heavily on debt, you mix equity from investors, contributions from supporters, and affordable City loans. This lowers your overall financial risk and gives you more flexibility to grow. If you’re going this route, be upfront with all your funding sources about your plans. Transparency builds trust and helps everyone work together to support your success.

Tips for Success When Combining Funding Sources

Mixing different types of financing can be a powerful way to get your business moving or growing, but it takes some thoughtful planning. Here are a few tips to help you succeed when combining City of Eau Claire loans with other funds:

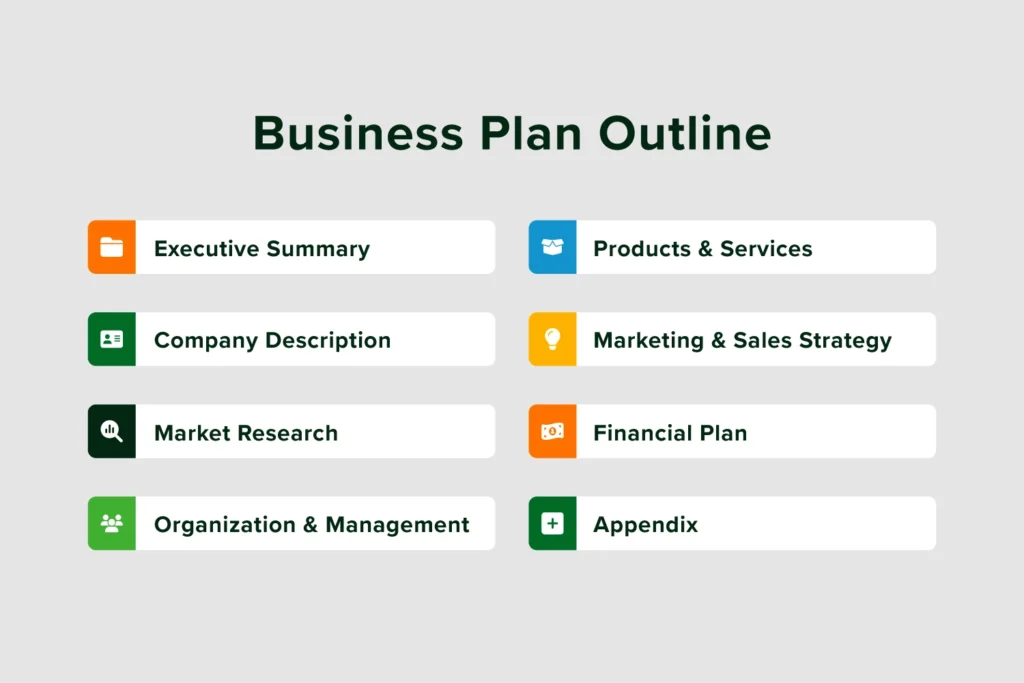

- Have a clear business plan. Lenders and investors want the full picture—how all the funding pieces fit together to support your goals. A strong plan shows you’ve thought through your strategy, use of funds, and how you’ll generate revenue to repay loans or deliver returns. The clearer the plan, the more confident your lenders will be.

- Know your numbers inside and out. Understand exactly how much funding you need, what each source covers, and repayment terms. How much will your City loan cover? What’s the bank loan’s interest rate? Are any grants or investments involved that don’t require repayment? Knowing these details helps avoid surprises and keeps your budget on track.

- Communicate openly and early. Don’t wait to tell your loan officer or investors you’re combining financing sources. Being upfront helps everyone understand your full financial picture, making approvals smoother. Open communication builds trust, which is key when juggling different lenders or partners.

- Plan for contingencies. Even the best projects can run into unexpected costs or delays. Having multiple financing sources creates a safety net so you’re not stuck scrambling for cash if things change. This flexibility keeps your project on track and avoids last-minute stress.

Ready to Explore Your Financing Options?

Interested in learning more about City of Eau Claire business loans and how they can work alongside other funding sources? The Economic Development Division (That’s us!) is here to help. Reach out for guidance tailored to your business goals and find the best financing mix to fuel your success. Remember, no matter your idea or stage, there’s usually a way to make the numbers work, and combining funding options can open doors you didn’t even know existed. Let’s get started!

Article Cover Illustration by Freepik