Disclaimer: The articles published here on the City of Eau Claire Economic Development Division website are meant to be a helpful starting point as you explore doing business in our community. They’re not the final word on requirements or what’s best for your unique situation. We always recommend checking in with legal, financial, or other professionals for advice tailored to your business.

Hiring help for your growing business in Eau Claire comes with a few important decisions.

One of the first questions you’ll need to answer is: Are you bringing on an employee or hiring an independent contractor? At first glance, the difference might not seem like a huge deal, but it matters. From taxes to day-to-day management, the distinction between an employee and a contractor can affect your operations, budget, and legal responsibilities.

Let’s break it down.

What’s the Difference?

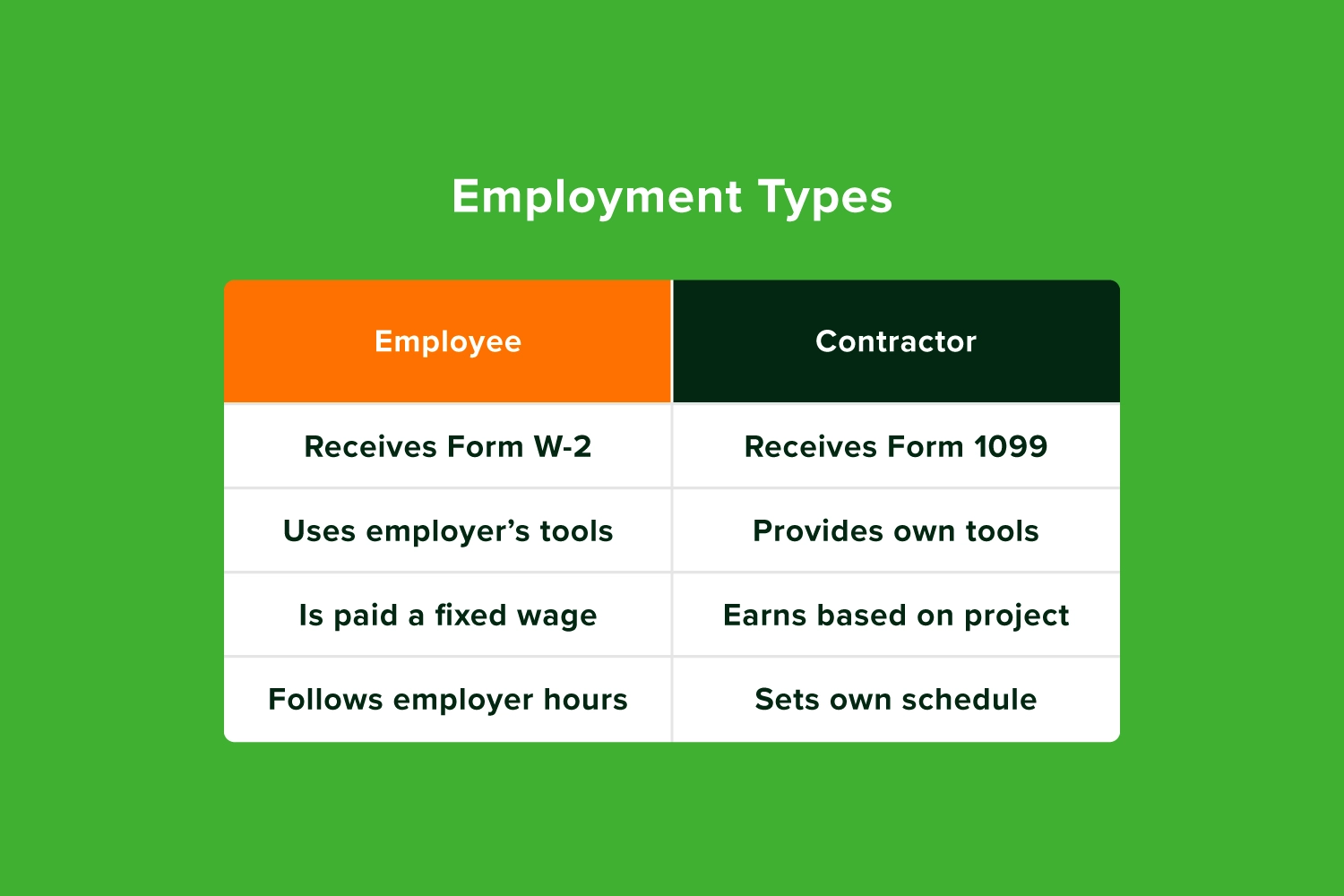

It comes down to how the work is done, how much control you have as the employer, and how the person you’re hiring is paid.

Let’s start with employees. These are people who become a regular part of your team. You set their schedule, provide the tools or equipment they need, and often give them training and ongoing supervision. You’re in charge of how they do their work, whether they’re helping customers at your front counter, assembling products in your shop, or managing your inventory. In return, you take on responsibilities like withholding payroll taxes, providing workers’ comp insurance, and following labor laws around things like overtime, breaks, and minimum wage. In short, you’re not just paying them; you’re managing them too.

Independent contractors, on the other hand, are self-employed professionals who provide a specific service to your business. You’re hiring them for their expertise—not to supervise their every move. They usually set their own hours, use their own tools, and decide how to get the work done. Maybe they’re building your website, deep cleaning your space after hours, or consulting on a strategic plan. You agree on the scope, the payment, and the timeline, and then once the job’s done, they move on to their next client.

Contractors invoice you for their services, pay their own taxes, and aren’t covered by the same laws that apply to employees. You’re not responsible for benefits, unemployment insurance, or payroll tax withholding.

If you’re still not sure how to tell the difference, here’s a quick shortcut:

- If someone is working regular hours at your location, using your equipment, and taking direction from you, they’re probably an employee.

- If they’re working independently, using their own tools, and juggling multiple clients, they’re likely an independent contractor.

And remember, it’s not about the job title or what you call them; it’s about how the relationship actually works in practice.

Why Does It Matter?

Classifying someone correctly isn’t just a paperwork detail. It’s a legal requirement. Even if you make an honest mistake, misclassifying someone as a contractor when they should be an employee can lead to some serious consequences. Think back taxes, fines, and penalties from the IRS, plus potential enforcement from the Wisconsin Department of Workforce Development (DWD). It’s one of those “better safe than sorry” situations.

Beyond the legal and financial risks, classification affects things like:

- Taxes – With employees, you’re responsible for withholding and paying payroll taxes (Social Security, Medicare, unemployment, etc.). Contractors handle their own.

- Benefits – Employees may qualify for paid time off, health insurance, or retirement contributions if you offer them. Contractors don’t.

- Workplace Protections – Employees are covered by labor laws that ensure things like minimum wage, overtime pay, rest breaks, and protection from wrongful termination or discrimination. Contractors are not.

- Unemployment & Workers’ Comp – You’re required to carry these protections for employees. Contractors are expected to cover themselves.

So yes, hiring a contractor can sometimes be a more flexible option, but only if the role truly fits that classification. If not, it could cost you more in the long run. Getting it right helps protect your business, keep you compliant, and build stronger, clearer relationships with the people you bring on board.

Common Contractor Roles in Eau Claire

In Eau Claire, lots of local startups and small businesses use independent contractors to get key projects off the ground without the commitment of hiring full-time staff. It’s a great way to bring in expertise when you need it.

Some of the most common contractor roles include:

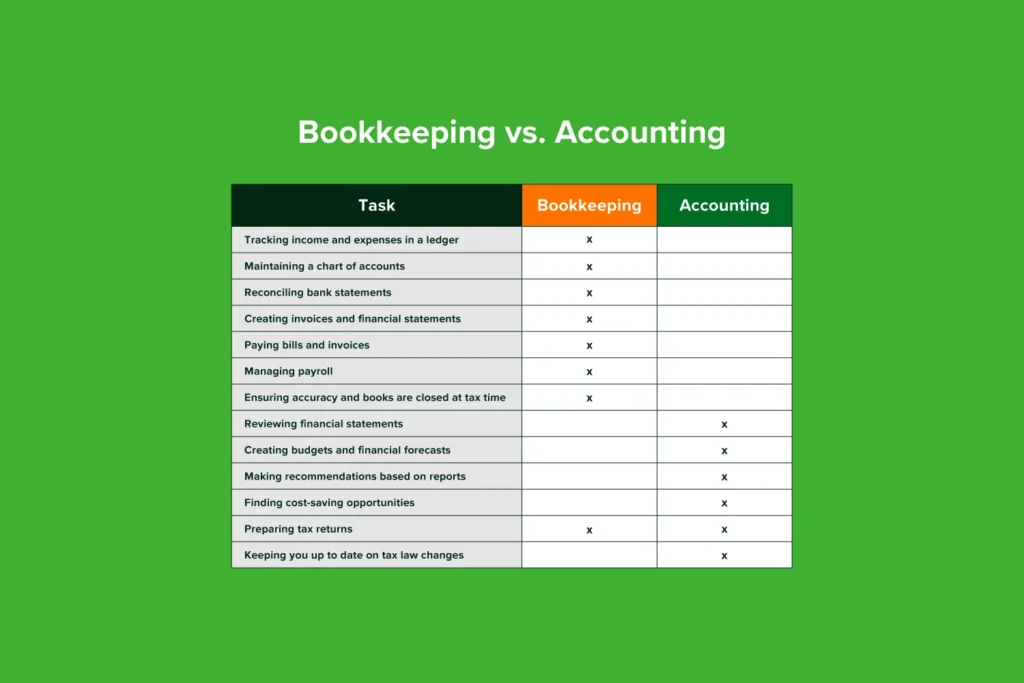

- Accounting or Bookkeeping – Keeping your books clean is essential, but if your transaction volume is low, you may not need someone in-house. A contractor can handle monthly reporting, taxes, or payroll support.

- Specialized Consulting or Coaching – Whether it’s HR, IT, business strategy, or industry-specific advice, many Eau Claire businesses bring in consultants to tackle a challenge or support a growth phase.

- Graphic Design – Need a logo, business cards, or signage? Designers are often hired per project to help shape your visual identity.

- Website Development – Whether you’re launching an online shop or building a basic service site, web developers are frequently hired for short-term builds and ongoing updates.

- Marketing or Social Media Support – Not every business needs a full-time marketing department, but nearly all need an online presence. Contractors can manage social posts, email campaigns, or digital ads without being on staff.

These roles are usually project-based or short-term, and the professionals filling them work independently. They bring their own tools, manage their own schedules, and deliver results—not hours.

If you’re not quite ready for a full-time hire but still need help getting things done, contractors can be a smart and strategic choice. Just make sure the arrangement fits the contractor model—minimal supervision, a clearly defined scope, and independent execution—and you’ll be on solid ground.

So, Which One Should You Choose?

There’s no universal answer. It all depends on your business’s needs and how the working relationship will function.

To help figure it out, ask yourself:

- Do I need this person to follow a set schedule or be onsite regularly?

- Will I be providing training, tools, or ongoing supervision?

- Is this a long-term role that’s essential to daily operations, or a one-time project with a clear start and end?

If you’re answering “yes” to the first two, you’re likely looking at hiring an employee. That means more responsibilities on your end, but also more control and consistency. If it’s a short-term or occasional project where the person will work mostly independently, then an independent contractor might be the better fit. They bring their own skills to the table and usually don’t need much oversight.

Still not totally sure? There are plenty of resources to help. The IRS has a helpful worker classification checklist, and the Wisconsin Department of Workforce Development (DWD) offers state-specific guidance. You can also connect with a local accountant, payroll provider, or business attorney. Even a quick consult can save you time, money, and stress down the line.

Summing It Up

Whether you’re hiring your first team member or just bringing in outside help, understanding the difference between employees and independent contractors is key to running your business responsibly. Get a handle on which you need from the start, and it’ll save you lots of potential headaches later on.