Disclaimer: The articles published here on the City of Eau Claire Economic Development Division website are meant to be a helpful starting point as you explore doing business in our community. They’re not the final word on requirements or what’s best for your unique situation. We always recommend checking in with legal, financial, or other professionals for advice tailored to your business.

One of the first things on your to-do list when starting a business in Eau Claire—right after naming your business and registering it with the state—should be opening a business bank account. It’s a big one when it comes to building a solid financial foundation. Having a separate business account keeps your finances organized, boosts your credibility, and makes tax season a lot easier.

Let’s walk through what you need to know to get set up right here in Eau Claire.

Why Do I Need a Business Bank Account?

Mixing your personal and business finances might seem like no big deal at first, but it can quickly become a tangle of confusion. A dedicated business account sets your business up to grow with confidence and clarity.

Why it matters:

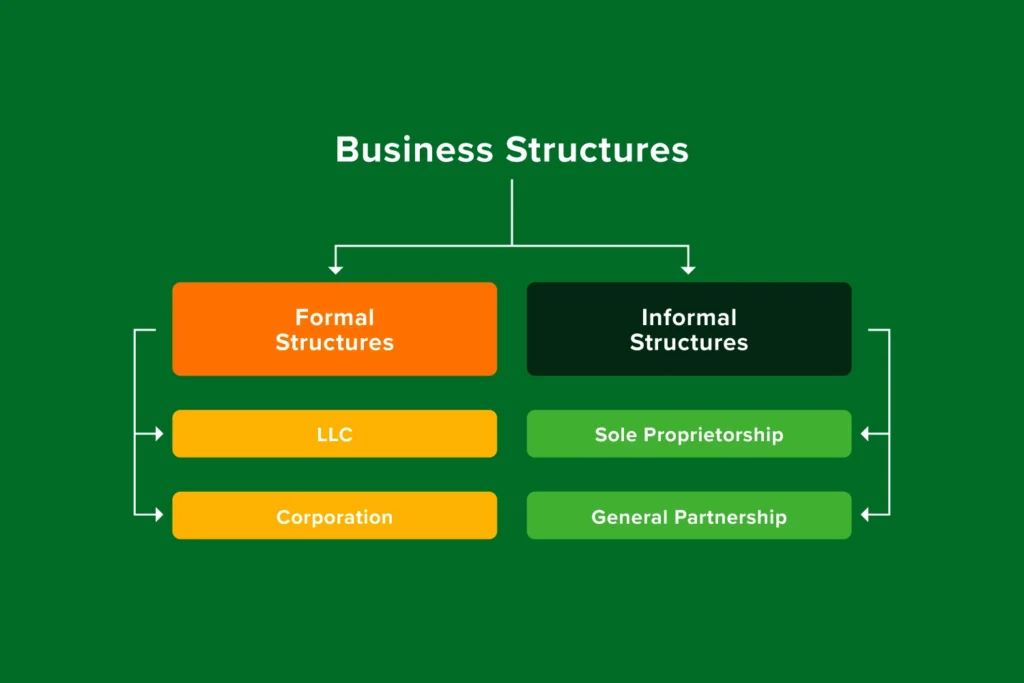

- It protects your legal structure. If you’re an LLC or corporation, keeping personal and business finances separate isn’t optional; it’s legally necessary. Blurring the lines can jeopardize your liability protection, putting personal assets at risk.

- It keeps your finances organized. When all your business income and expenses flow through one account, it’s much easier to track your financial performance. No guessing whether that Amazon charge was for office supplies or dog treats.

- It simplifies tax time. Come tax season, you and your accountant will be thankful for clean, separate records. Clear boundaries between personal and business spending reduce the risk of missing deductions or triggering red flags with the IRS.

- It builds your banking relationship. Your bank is more than a place to stash cash. Over time, a strong relationship can open doors to loans, lines of credit, and other financial tools, especially if you’ve already established yourself as a reliable business customer.

- It makes you look more professional. Using a business account to write checks and accept payments in your business’s name sends a message: you’re serious, trustworthy, and running a real operation—not just a side gig.

Bottom Line: Opening a business bank account is one of the smartest first steps you can take to protect and grow your business.

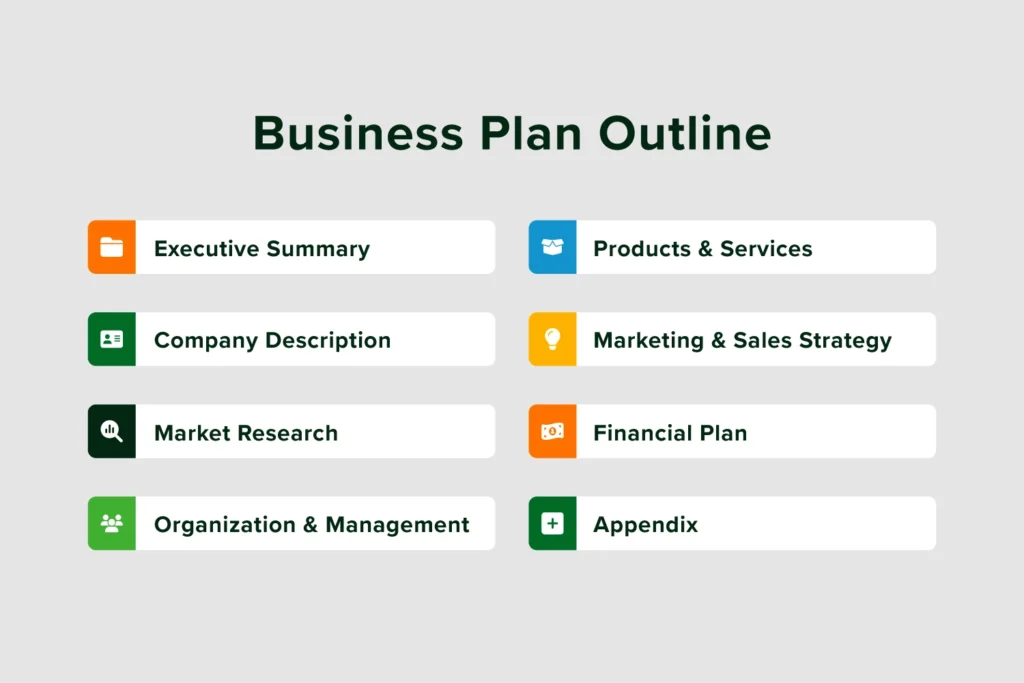

What Do I Need to Open an Account?

Before you head to the bank or hop online, it’s helpful to gather a few key documents. Every bank is a little different, and requirements can vary depending on how your business is set up, but having the basics ready to go will save you time and frustration.

What you’ll typically need:

✅ Business Formation Documents

These show how your business is legally registered in Wisconsin. For LLCs, that’s your Articles of Organization; for corporations, it’s your Articles of Incorporation. Sole proprietors who’ve registered a trade name (DBA) should bring proof of that too.

✅ Operating Agreement or Bylaws

Not always required but often requested, especially for multi-member LLCs or partnerships, this document outlines how your business is structured and who has authority over financial decisions. Even for single-member LLCs, it’s a good idea to have one.

✅ Employer Identification Number (EIN)

Think of this as your business’s Social Security Number. The IRS issues it for tax purposes, and most banks require it even if you don’t have employees. If you don’t have one yet, you can apply for an EIN online via the IRS website; it’s free and takes just a few minutes.

✅ Business License or Permit (If Applicable)

Eau Claire doesn’t require a general business license, but certain industries like food service, personal care, or construction do. If your business falls into one of those categories, bring copies of your licenses or permits.

✅ Valid Photo ID

Bring your driver’s license, state ID, or passport. The bank needs to verify your identity and make sure you’re authorized to open the account on behalf of your business.

Pro Tip: Every financial institution has its own process. Some allow you to start online and upload documents digitally, while others prefer in-person appointments, especially for new business customers. Call ahead or check the bank’s website to avoid surprises. Either way, having your paperwork ready means less time waiting and more time focusing on what matters—running your business.

What Kind of Account Should I Get?

Banks and credit unions offer all kinds of business accounts, and the right one for you depends on where you are in your business journey.

If you’re just getting started—whether with a pop-up, a home-based business, or your first storefront—you probably don’t need all the bells and whistles yet. A basic business checking account with low (or preferably no) monthly fees, a reasonable number of free transactions, and solid online banking features is a great place to begin.

What to look for:

- No or low monthly maintenance fees (or an easy way to waive them)

- A healthy number of free transactions each month (deposits, transfers, etc.)

- Convenient online and mobile banking

- Nearby branches in case you need in-person support or make cash deposits

- ATM access that works for your business’s needs

As your business grows, your banking needs may grow too. You can always add or upgrade to services like:

- A business savings account to set aside funds for taxes, emergencies, or future investments

- A merchant services account to process credit card payments

- A business credit card to build credit and keep spending separate

- Cash management tools to help with payroll, budgeting, and higher transaction volumes

Some banks even offer bundled small business packages that include multiple account types and financial planning resources. Don’t be afraid to ask what’s available. At the end of the day, the right account is the one that works for you. Take the time to compare options, and choose a bank that understands your business.

Bonus Tip: Build a Relationship

A bank account might be your first step into the business financial world, but it shouldn’t be your last interaction with your bank.

Building a relationship with your banker can open doors, especially when you’re ready to grow. Need a loan? Applying for a line of credit? Exploring financing options? Having someone at the bank who already knows you and your business can make those conversations faster, easier, and more productive.

Even beyond funding, your banker can be a valuable resource. Whether you’re setting up merchant services, exploring credit cards, or trying to figure out the best way to manage your cash flow, they can help tailor the right solution for your needs—not just sell you products.

Here in Eau Claire, many local banks and credit unions have small business specialists or commercial banking teams who are genuinely excited to support local entrepreneurs. They want to see you succeed, so don’t hesitate to reach out or schedule a quick meeting.

At the end of the day, a strong banking relationship isn’t just for big corporations. It’s a smart, strategic move for small businesses and startups too, and it all starts with a conversation.

Wrapping Up

Opening a business bank account may not sound like a big step, but it makes a big difference as you get your business up and running. With a little prep and the right financial partner, you’ll be ready to manage your business finances with confidence and focus on what matters most: building something great in Eau Claire.

Article Cover Illustration by Freepik