Disclaimer: The articles published here on the City of Eau Claire Economic Development Division website are meant to be a helpful starting point as you explore doing business in our community. They’re not the final word on requirements or what’s best for your unique situation. We always recommend checking in with legal, financial, or other professionals for advice tailored to your business.

If you’re just getting the doors open to your new business in Eau Claire, you’re juggling a lot, from building your brand and attracting customers to making sure the day-to-day runs smoothly. In the middle of it all, managing your books might feel like just another chore, but it’s one of the cornerstones of a healthy business. Solid bookkeeping and accounting help you understand where your money’s going so you don’t find costly surprises.

You don’t need to love numbers to get it right. With just a few simple habits and the right approach, you can keep your finances organized and your business on track from day one. This handy guide goes over the basics.

What’s the Difference Between Bookkeeping & Accounting?

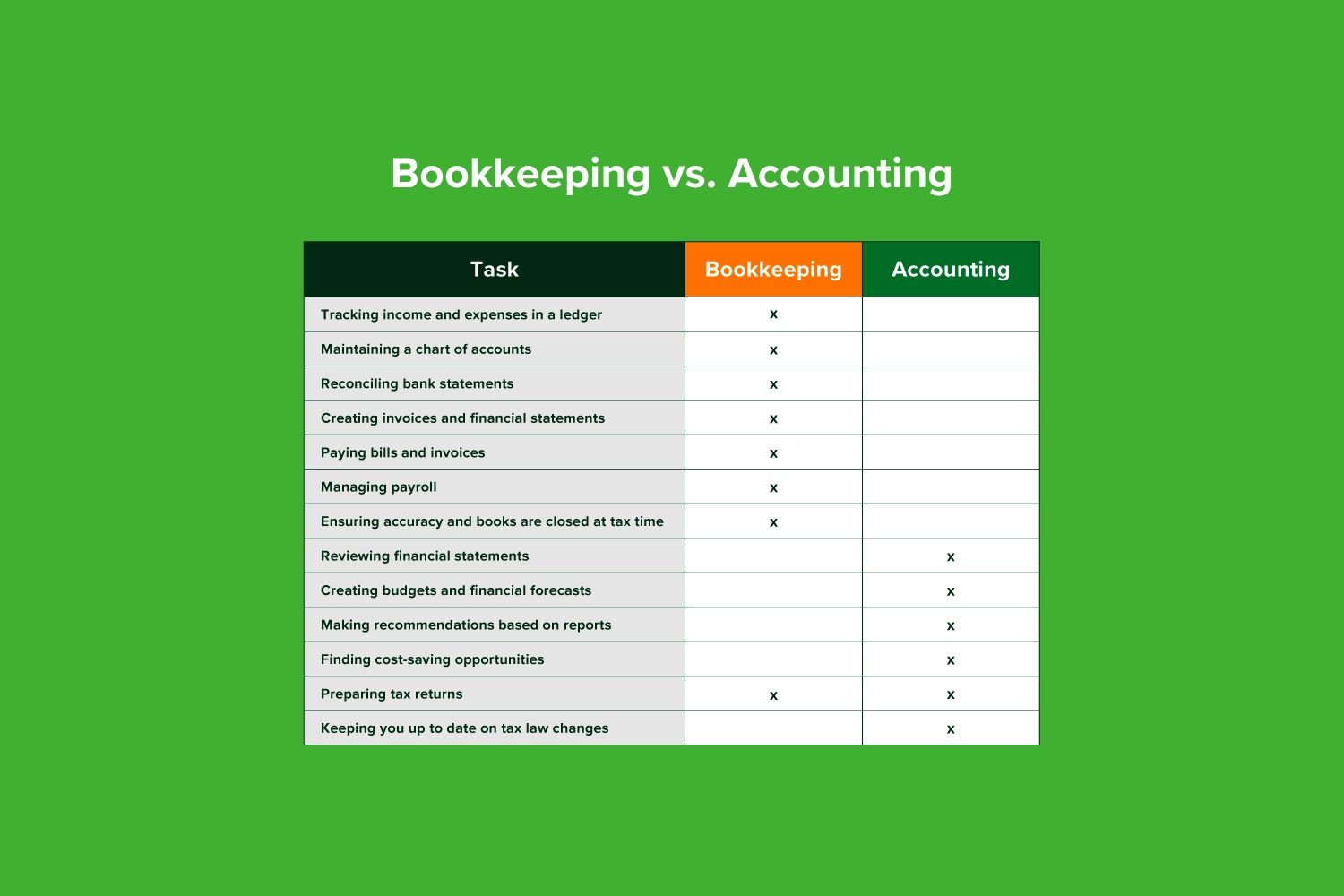

Before we dive in, it’s important to clear up a common mix-up: bookkeeping and accounting are closely connected but are not the same thing. Knowing the difference helps you figure out what your business needs at different stages.

Bookkeeping: The Day-to-Day Financial Tracker

Bookkeeping should be considered the foundation of your business’s financial house. It’s all about recording every financial transaction as it happens—every sale, every bill you pay, every invoice you send out. In other words, bookkeeping means keeping a clear, organized log of all the money flowing in and out.

For example, if you sell a latte at your new Eau Claire coffee shop, your bookkeeper records that sale. If you buy supplies from a local vendor, that’s logged too. Keeping up with these details means you won’t lose track of any financial activity.

Bookkeeping tasks include:

- Tracking income and expenses

- Reconciling bank statements

- Managing invoices and bills

- Organizing receipts and financial documents

Depending on how busy your business is, this can happen daily, weekly, or monthly. Accurate bookkeeping means you’ll always know where your money stands so you can avoid surprises.

Accounting: Making Sense of the Numbers

While bookkeeping records the raw data, accounting is where the story behind those numbers comes alive. Accountants analyze the financial records to give you insight into how your business is really doing.

They take your bookkeeping info to prepare key reports like:

- Profit & Loss Statements (How much money you made or lost)

- Balance Sheets (What your business owns and owes)

- Cash Flow Statements (How cash moves in and out over time)

Accounting goes beyond reports too; it includes planning and advice. For example, an accountant can help you:

- Understand your tax obligations and prepare filings

- Create budgets and financial forecasts

- Spot cost-saving opportunities or areas to invest

- Make informed decisions to grow your business

To put it simple, bookkeeping is the ongoing process of gathering and organizing your business’s financial data. It’s all about accuracy and detail. Meanwhile, accounting takes that data and interprets it, giving you a bigger picture of your business’s financial health and future direction.

For Eau Claire startups, mastering bookkeeping lays the groundwork, but solid accounting guidance turns those numbers into smart business moves. Both are important, and together they keep your business financially healthy and ready to thrive.

Why This Matters For Eau Claire Startups

Eau Claire’s business community is buzzing—entrepreneurs are opening new shops, launching innovative services, and building exciting startups every day. Whether you’re just getting started or growing, one thing’s clear: knowing exactly where your money is going and how much you have isn’t just helpful… it’s critical if you’re going to compete in our bustling market.

The truth is, without good bookkeeping and accounting, you’re basically flying blind. You won’t know if your business is making money or losing it, if you’re missing payments, or if you’re setting yourself up for trouble come tax time. In a community like Eau Claire, where local support and smart financial management go hand in hand, that clarity can make the difference between success and struggle.

How Good Bookkeeping Helps Your Business

- Stay Organized & Avoid Missed Payments: Detailed records help you avoid late fees, service interruptions, and scrambling to pay vendors. In Eau Claire’s close-knit business scene, a reputation for paying on time matters.

- Track Expenses for Tax Time: Taxes can be tricky, especially with Wisconsin’s specific rules. Good bookkeeping ensures you have your receipts and records ready, so tax season isn’t a scramble. Plus, it helps you claim every deduction you qualify for, which saves you money.

- Spot Opportunities to Save or Invest: Up-to-date books show you where your money goes. Can you cut costs? Should you invest in equipment or marketing? Clear records give you the insight to make smart calls.

What Accounting Brings to the Table

- Make Informed Decisions About Growth & Spending: Accounting helps you plan ahead. When to hire new staff, expand your offerings, or open a second location becomes clearer with solid financial reports.

- Understand Your Business’s Profitability & Cash Flow: It’s about more than sales; accounting helps you manage costs and cash flow so you’re not blindsided by slow months or surprise expenses.

- Prepare for Financing or Loans: If you’re applying for a loan or pitching investors in Eau Claire, having clean, accurate financials shows you mean business. Lenders want to see well-prepared records before they say “yes.”

- Stay Compliant with Tax Laws & Reporting: Tax laws change, and mistakes can cost you. An accountant keeps you current on local, state, and federal regulations, helping you stay compliant and stress-free.

Bookkeeping and accounting are powerful tools that keep your business healthy, help you grow confidently, and lead to opportunities you can seize in Eau Claire’s supportive business environment. Knowing your numbers means smarter decisions and a thriving business.

Getting Started: Simple Bookkeeping Tips for Eau Claire Entrepreneurs

You don’t need a finance degree to keep your business books in order. Here’s how to get going with bookkeeping for your Eau Claire startup:

1. Separate Your Business & Personal Finances

This sounds basic, but mixing business and personal money leads to confusion, especially at tax time. Opening a business bank account at a local Eau Claire bank or credit union keeps things neat and simple. It helps track business income and expenses clearly and builds credibility with customers, vendors, and lenders.

2. Choose a Bookkeeping System That Works for You

Whether you prefer pen and paper, spreadsheets, or digital tools, pick a system that fits your style and business needs.

- Spreadsheets: Microsoft Excel or Google Sheets can work if you’re comfortable and have fewer transactions.

- Bookkeeping Software: QuickBooks, Xero, or Wave simplify tracking by importing bank transactions, generating reports, and even handling invoicing. Many integrate with banks and payment systems, saving time and reducing errors. Plus, they come in different price ranges, including free options.

3. Record Transactions Regularly

Don’t wait for tax season. Instead, set aside time weekly or monthly to enter your transactions. This helps catch mistakes early and get a real-time picture of your finances. Even spending just 30 minutes a week updating sales and expenses keeps you ahead.

4. Keep Receipts & Invoices Organized

Receipts pile up fast, but staying organized is key, and not just for bookkeeping but for tax deductions too. Digital tools like Evernote or snapping photos on your phone make this easy. You can also scan and store documents in Google Drive or Dropbox for quick access. If you have paper receipts, keep them in one place like a folder until you enter the details.

5. Know Your Tax Deadlines

Wisconsin’s tax deadlines and rules matter, and missing them can mean fines. Keep a calendar for important local, state, and federal tax dates. Sign up for reminders from the Wisconsin Department of Revenue (DOR) or check in with a local accountant familiar with Eau Claire’s tax landscape. Staying organized all year will make tax time less stressful and might help you find tax savings you didn’t expect.

When to Bring in a Pro

Bookkeeping and basic accounting are manageable at first, but if numbers start to feel overwhelming or you want to make sure you’re on the right track before big decisions, it might be time to hire a professional accountant.

Eau Claire is fortunate to have experienced local CPA firms and accounting pros who specialize in supporting startups and small businesses like yours. They understand the unique challenges and opportunities of doing business here.

How an Accountant Can Help Your Startup

- Tax Planning & Filing: Tax laws change often. An accountant helps file your taxes accurately and on time and plans ahead to minimize your tax burden and maximize deductions, staying current on Wisconsin rules.

- Financial Forecasting & Budgeting: Planning to grow? Accountants help build realistic budgets and forecasts based on your goals, so you know when to expect cash flow highs and lows and avoid surprises.

- Advice on Payroll, Sales Tax, & More: Payroll and sales tax can be tricky and costly if mishandled. A pro guides you through requirements, sets up compliance systems, and handles the paperwork.

Having an accountant means you’re not alone managing your finances. Instead of spending hours buried in spreadsheets, you can focus on what you do best, whether that’s serving customers, developing your product, or expanding in Eau Claire. Plus, a trusted local accountant understands our market and economy. They can connect you to helpful networks and financial opportunities you might not find alone.

Summing It Up

No, bookkeeping and accounting aren’t flashiest parts of starting your business, but they’re absolutely foundational. Nail these basics, and you’ll have a clearer picture of your business’s health plus the confidence to grow and thrive right here in Eau Claire.